How Viva Money Supports a Stress-Free Financial Lifestyle?

Money is a major contributor to stress in most people’s lives. Financial matters like paying bills, managing expenses, or saving for the future are the main reasons that cause stress and take people’s minds off other important things. In this fast-paced world, people want to use simple and more advanced tools for money management that will help them to be efficient and relaxed. Thus, Viva Money is a digital tool that simplifies the whole process of borrowing and financial planning and makes it faster, easier, and free of hassle.

Handling your finances used to be a very time-consuming, tiresome, and paper-collecting process. Nevertheless, due to the spread of digital technology, managing your finances has become incredibly convenient. Now, with the help of apps like Viva Money, people borrow, plan, and handle everyday financial needs have been shifted. Let’s understand how the modern approach supports users to have a balanced and serene financial life.

Simplifying Borrowing for Everyday Needs

Depending on the type of unexpected expense one is facing, it may be medical bills or urgent repairs to the house. In the past, people would turn to banks, friends, or family members for assistance when such situations occurred. However, one of the biggest advantages of the utilization of platforms like Viva Money is that acquiring quick financial aid is right at fingertips.

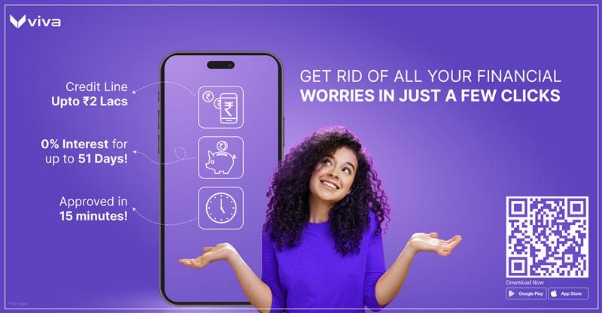

All the steps in the process are to be executed digitally, which implies that no visits to a bank or no filling in of complex application forms are required from the side of the users. The whole procedure from applying to approving is conducted on the app. After just a few minutes, the sum that has been approved is transferred straight into the user’s bank account.

This speed and convenience reduce the anxiety that often comes with borrowing. Knowing that funds are available instantly provides a sense of security. Whether it’s an emergency or a planned expense, users can handle their needs confidently without worrying about delays or complicated procedures.

A 0% Interest Credit Line for Flexibility

One of the most powerful features that sets Viva Money apart is its 0% interest credit line for a grace period of 51 days. This gives users the ability to borrow and repay without extra financial pressure. It’s a refreshing change from traditional loans that often come with heavy interest charges.

This flexibility helps people manage their monthly cash flow better. For example, if someone needs to make a big purchase or pay an unexpected bill, they can use the credit line and repay later without additional cost. It removes the guilt and fear often associated with borrowing and replaces it with confidence and control.

Having this kind of financial cushion means users can focus on their priorities instead of constantly worrying about money. It supports a smoother, more relaxed financial lifestyle.

100% Digital and Paperless Experience

The digital experience offered by Viva Money is designed for simplicity. There’s no need for physical document submission or long approval waiting times. The platform uses secure digital verification to ensure quick and safe access to credit.

The whole paperwork procedure is now a thing of the past, and all these procedures are now digital. Besides, the whole process was not only time-consuming but also required the user to keep track of different documents mentally. Now, everything is shown in the app, from loan status to repayment schedule. The users can check their balances, keep track of their payments, and even withdraw money whenever they want, all from a single source.

Such transparency is a factor that contributes to reducing the mental burden. There is less confusion and less anxiety if you are always aware of the exact amount you owe and the due dates for your repayment. The app’s design makes the user feel that they are the ones controlling the finances, not the situation that is overwhelming them.

Promoting Financial Awareness and Discipline

No-stress financial life is not just about easy access to cash; it is also about the ability to manage it wisely. Viva Money encourages responsible borrowing by helping users understand their credit behavior. Through the application, users have control over finances via a user-friendly dashboard and notifications that help users to be consistent in saving and spending wisely.

It keeps the borrower within his/her limit and hence reduces the risk of falling into the trap of unnecessary debt. This way of dealing with customers allows the borrower to acquire the skills of mastering credit management and, at the same time, increase personal finances to the point of being stable in the long run. Over time, this awareness leads to smarter spending habits and more mindful money decisions.

The digital transition has also made learning about personal finance easy. The users get to learn without the feeling of being overwhelmed with the use of simple expressions, clear functionalities, and transparent systems. No more reliance on complex banking vocabulary to comprehend your finances.

Empowering Financial Independence

In the modern world, financial independence is key to personal peace. Viva Money empowers individuals by giving them direct control over their borrowing and repayment journey. Whether it’s a student managing expenses or a working professional planning monthly costs, the platform provides equal opportunities for everyone to access financial support.

For many users, the freedom to manage money without external dependency is deeply satisfying. It builds confidence and reduces the feeling of financial uncertainty. Having a reliable money app like Viva Money allows users to focus on life goals instead of worrying about every expense.

This independence also promotes equality. People who once found it hard to approach banks or traditional lenders can now use digital tools to achieve their goals. The app removes social and geographical barriers, giving everyone an equal chance at financial stability.

A Smarter Way to Borrow Responsibly

One of the best things about the new digital lending model is how it balances comfort and caution. Viva Money’s design ensures borrowing remains safe, transparent, and purposeful. Users can borrow small or large amounts depending on their needs, with complete clarity about repayment terms.

This structured yet flexible system makes borrowing feel lighter and more manageable. The built-in repayment reminders and user-friendly interface reduce the chances of missed payments or confusion. For people who value financial discipline, this system offers both freedom and structure.

When handled wisely, these modern lending solutions reduce financial anxiety and improve overall well-being. They encourage users to see credit not as a burden but as a tool for growth. For additional support, those who need quick funds can explore trusted digital platforms or a loan app that offers similar transparent benefits.

Conclusion

Financial peace is not about having unlimited money; it’s about having control, clarity, and confidence in your finances. Viva Money provides all three. With instant access, 0% interest flexibility, and a fully digital experience, it helps people manage money without stress.

The app empowers users to handle emergencies smoothly, plan expenses better, and stay financially independent. In a world where money worries can easily take over, Viva Money brings calm and balance. It’s not just about borrowing, it’s about creating a financial lifestyle that feels light, secure, and completely stress-free.

Keep an eye for more latest news & updates on Internal Insider!